Mastering Double Entry Bookkeeping for Accounts Payable: A Step-by-Step Guide

Efficient bookkeeping is the backbone of a successful business, and when it comes to managing accounts payable, mastering the art of double-entry bookkeeping is essential. In this comprehensive guide, we’ll walk you through the ins and outs of handling accounts payable using the double-entry system, ensuring accuracy, compliance, and a clear financial picture for your business.

Understanding Double Entry Bookkeeping:

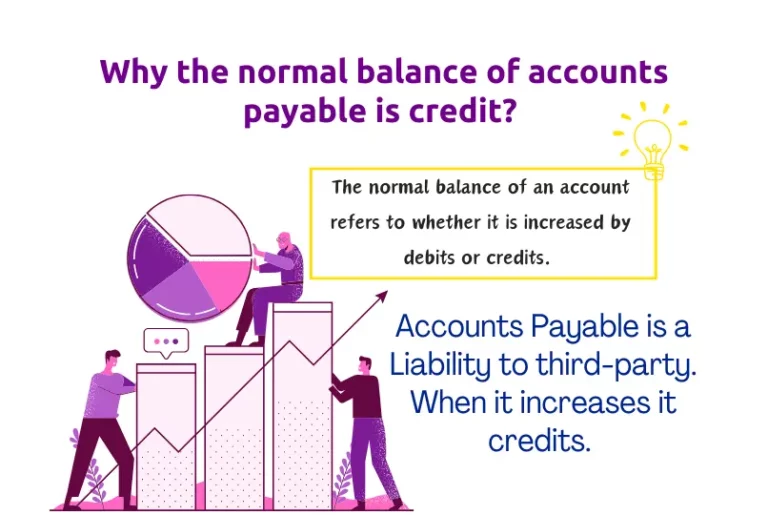

Double-entry bookkeeping is a method that records every financial transaction with at least two entries, debits, and credits, to maintain the accounting equation: assets = liabilities + equity. When dealing with accounts payable, this system ensures a comprehensive and balanced representation of your financial transactions.

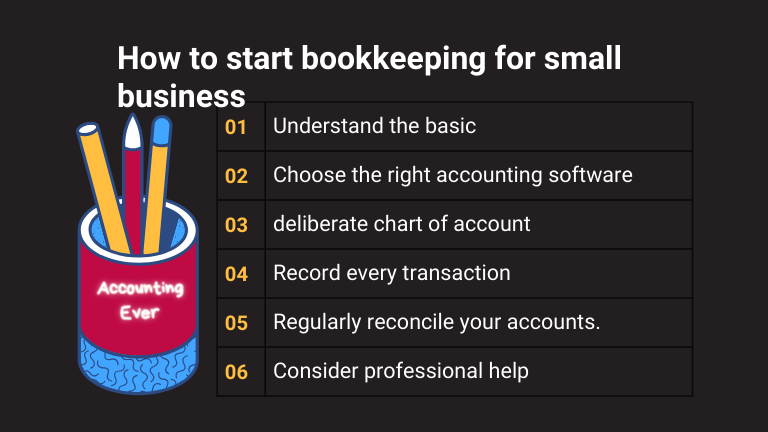

Step 1: Set Up Your Chart of Accounts:

Start by organizing your chart of accounts to reflect accounts payable. Common accounts related to accounts payable include “Accounts Payable,” “Purchases,” and “Expenses.” Customize your chart of accounts to suit the specific needs of your business, ensuring clarity and accuracy in recording transactions.

Step 2: Record Purchases and Invoices:

When you receive an invoice for goods or services, record the transaction in your accounts payable. Debit the accounts payable account to increase the liability, and credit the corresponding expense account to recognize the cost. This dual-entry ensures that your books stay balanced.

Step 3: Make Timely Entries:

Consistency is key in double-entry bookkeeping. Make it a practice to record transactions promptly to avoid discrepancies and maintain an accurate representation of your accounts payable. This includes recording purchase invoices, credit notes, and any adjustments promptly.

Step 4: Reconcile Accounts Regularly:

Regular reconciliation is crucial for accounts payable. Reconcile your accounts payable ledger with vendor statements and invoices to ensure that all transactions are accounted for accurately. This step helps identify any discrepancies and maintains the integrity of your financial records.

Step 5: Handle Discounts and Credits:

If you receive discounts or credits from your suppliers, record these transactions accurately. Debit the accounts payable account for the reduced amount and credit the corresponding expense account. This ensures that your financial statements reflect the actual costs incurred.

Step 6: Stay Organized with Document Management:

Maintain an organized document management system for invoices, receipts, and other accounts payable documents. This not only streamlines your bookkeeping process but also ensures you have the necessary documentation for audits and compliance.

Step 7: Leverage Accounting Software:

Consider using accounting software to streamline your double-entry bookkeeping for accounts payable. Tools like QuickBooks or Xero automate many aspects of the process, reducing the risk of errors and saving you time.

Conclusion:

Mastering double-entry bookkeeping for accounts payable is a fundamental skill that empowers you to maintain accurate financial records and make informed business decisions. By following these steps and embracing the principles of double entry, you’ll not only streamline your bookkeeping process but also lay a solid foundation for the financial health and success of your business.