Understanding the Normal Balance of Sales Returns and Allowances

In the intricate world of accounting, mastering the basics is crucial for maintaining accurate financial records.

One common area that often raises questions is what is the normal balance of sales returns and allowances? The answer is- Debit.

In this blog post, we’ll delve into the concept, demystify its normal balance, and equip you with the knowledge.

Table of Contents

Sales Returns and Allowances: A Brief Overview

Sales returns and allowances are accounting transactions that occur when customers return products or when a seller grants a reduction in the selling price due to defects or other negotiated terms. While these transactions may seem straightforward, understanding their normal balance is key to keeping your financial records in order.

Normal Balance Demystified

In the accounting world, each account has a normal balance—either debit or credit. For sales returns and allowances, the normal balance is on the credit side. This might seem counterintuitive at first, as one would expect returns to be a negative aspect of revenue. However, this accounting convention allows for a clear representation of reductions in sales revenue.

Why the Credit Side?

Contra Revenue Account:

Sales returns and allowances are considered contra revenue accounts. Contra accounts offset the balance in their related revenue accounts, in this case, sales revenue. By placing sales returns and allowances on the credit side, you effectively reduce the overall revenue balance, providing a true representation of the net sales.

Reflecting Reductions in Revenue:

The credit balance associated with sales returns and allowances directly reflects a reduction in the total revenue generated by your sales. This accounting approach aligns with the principle of accurately portraying the financial health of your business.

Navigating the Accounting Entries

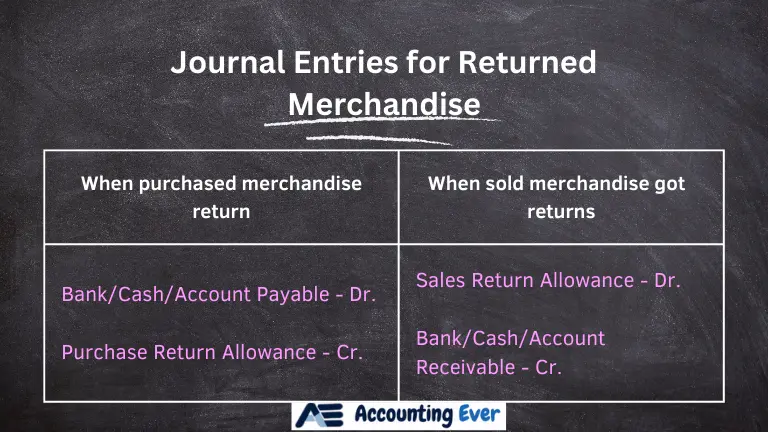

When a customer returns a product or receives a reduction in the selling price, the accounting entries are as follows:

Debit (Increase): Sales Returns and Allowances

Credit (Decrease): Accounts Receivable or Cash (depending on the original method of payment)

These entries not only capture the reduction in revenue but also adjust the accounts receivable or cash, providing a holistic view of the financial impact of returns and allowances.

Conclusion

Understanding the normal balance of sales returns and allowances is a foundational aspect of maintaining accurate financial records. By recognizing that these transactions belong on the credit side, you’re better equipped to reflect the true financial picture of your business. Embrace this knowledge, and navigate the world of accounting with confidence, ensuring that your financial statements truly reflect the ebb and flow of your business transactions.